AAA Rating

Read below for contact

info and disclosure.

Unique service. Better rates.

AAA Rating

Read below for contact

info and disclosure.

For Questions please contact us:

310.321.6750

info@mcglend.com

CA DRE CORP #01857042

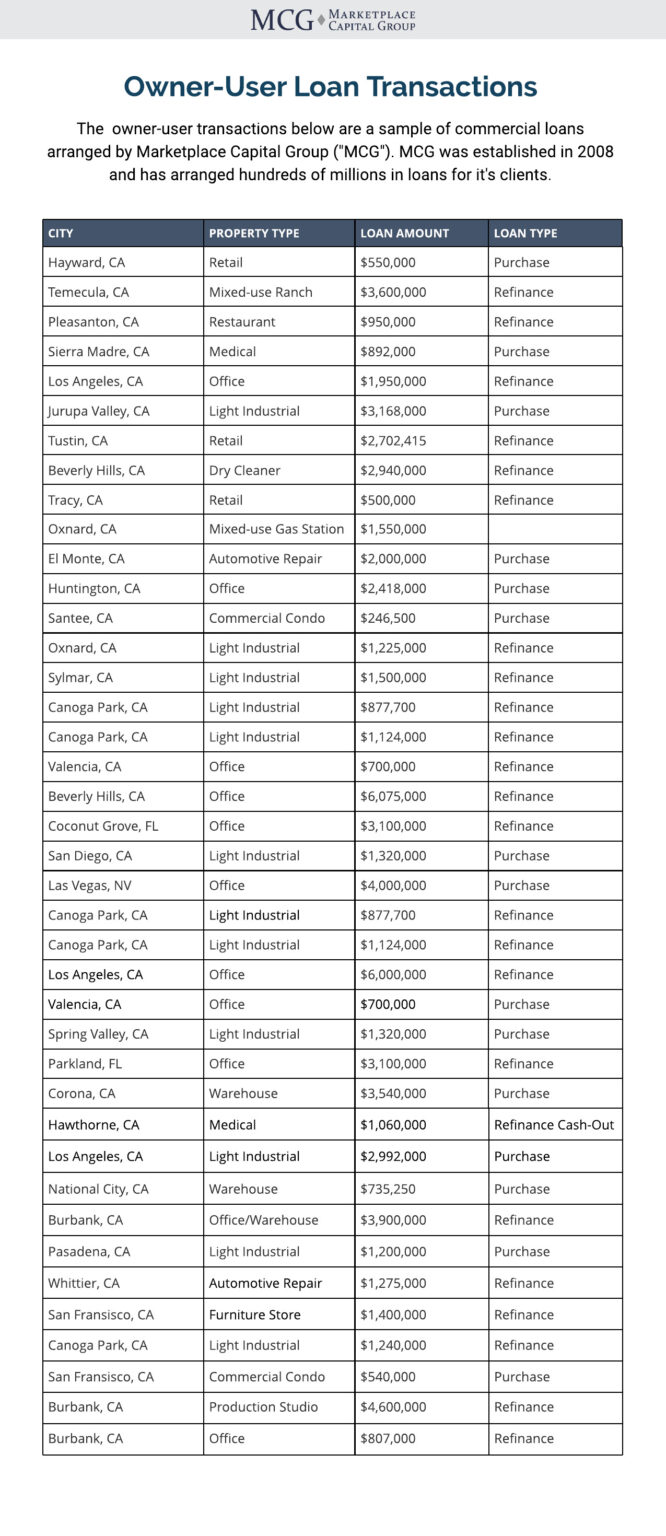

Marketplace Capital Group (MCG) is a privately owned commercial mortgage company that arranges multifamily, commercial, and private money mortgages. At MCG, we believe there is a better way to provide commercial real estate financing and strive to deliver a more valuable, less expensive way for real estate investors to finance their commercial properties. Since 2008, we have made sure to offer exceptional loan programs with some of the most competitive rates in the market! We also believe there is no “one size fits all” when it comes to income property loans, which is why we provide an extensive variety of commercial loan options. Let MCG save you or your client thousands of dollars by arranging a low, fixed-rate loan that fits your financing needs best.

President &

Founder

Dan has spent over 30 years as a former bank subsidiary president, mortgage banker, and commercial mortgage broker. During his career, he has managed multiple loan originators and has originated residential and income properties as well. The combined loan originations over the course of his management and personal loan production has exceeded 6 billion dollars.

MCG was created with Dan’s vision to start a unique commercial mortgage company with an array of strategic, institutional alliances that would provide loan production channels for the most competitive and disruptive loan programs in the marketplace.

He has been married to his wife, Jen, for the past 23 years. They have three sons and a beloved dog, Taquito. Their residence is in Rancho Palos Verdes, CA, where they have lived for 20 years.

Dan has spent over 30 years as a former bank subsidiary president, mortgage banker, and commercial mortgage broker. During his career, he has managed multiple loan originators and originated residential and income properties as well. The combined loan originations over the course of his management and personal loan production have exceeded 6 billion dollars.

MCG was created with Dan’s vision to start a unique commercial mortgage company with an array of strategic institutional alliances that would provide loan production channels for the most competitive and disruptive loan programs in the marketplace.

He has been married to his wife, Jen, for the past 25 years. They have three sons and a beloved dog, Taquito. Their residence is in Rancho Palos Verdes, CA, where they have lived for 20 years.

Since 2008, the MCG team has focused their time in supporting and arranging major multifamily and commercial loans nationwide. Our focus is to provide personalized solutions that cater to yours and our clients’ needs. We do this by arranging loan programs for our borrowers that will provide them with the best value possible and offer some of the most competitive rates you will find in the marketplace. It is our priority to make sure our clients are well taken care of. We look forward to building a lasting relationship with you.

President & Founder

Direct: (310) 435-0595

Office: (310) 321-6750 ext. 2

Email: dan@mcglend.com

CA DRE #01320725

Senior Commercial Loan Advisor

Direct: (415) 258-8331

Email: jeff@mcglend.com

CA DRE #00533244

Manager of Operations

Office: (310) 321-6750 ext. 1

Email: jen@mcglend.com

Senior Commercial Loan Advisor

Direct: (909) 289-1550

Email: mark@mcglend.com

CA DRE #00786547

Executive Assistant

Project Manager

Marketplace Capital Group

HERE

WE GO!

Secure Drop Box Available Upon Request

Rates, fees and terms are subject to change without notice. Marketplace Capital Group (”MCG”) is a division/dba of Marketplace Capital Partners, a CA DRE, Corp. license 01857042, commercial mortgage company. MCG offers an array of Multifamily, Commercial and Private Money Programs through strategic relationships with Banks, Credit Unions and other financial income property loan programs. All loan requests must meet lender's formal loan approval, requires borrower’s financials, credit worthiness, minimum debt coverage ratio, credit requirements and acceptable subject property collateral based on lender engaged appraisal request. Other conditions may apply. No APRs stated, recourse required, call for further loan program details. This landing page is intended for Commercial Real Estate Investors, DRE licensed Mortgage Brokers, Salespersons and Real Estate Brokers only and not for general public. Marketplace Capital Group Copyright 2024.

Sign-up for our newsletter and get the PDF for free.